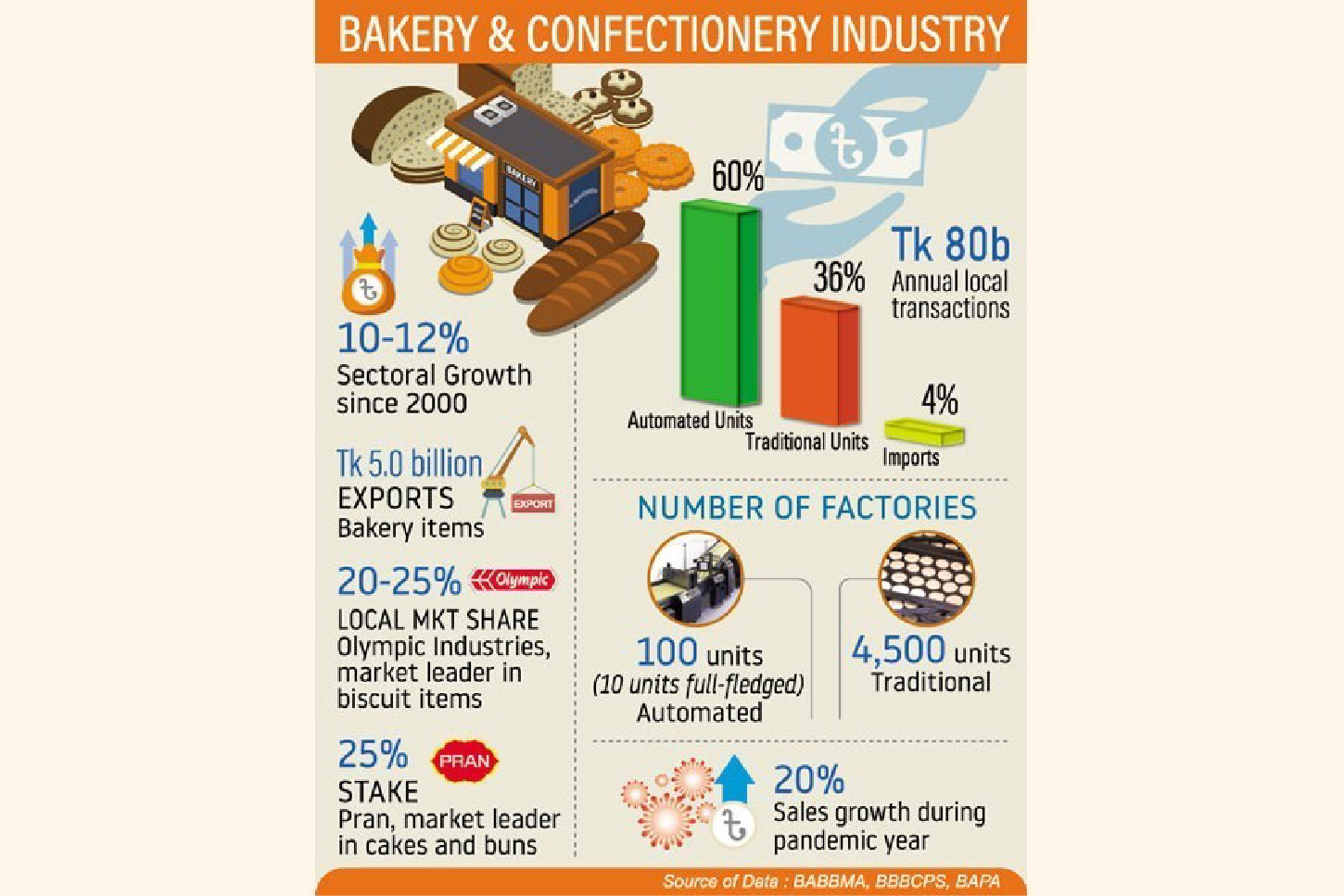

Country''s bakery and confectionery industry has become almost self-sufficient in meeting the local demand, thanks to entrepreneurs who have invested heavily to produce quality items and import substitutes. The industry has already made a mark in the international market, attracting more local investors, particularly the large conglomerates, to put their money in the business, industry insiders have said. They said less than 4.0 per cent of the products in this category were now coming through imports, especially high-end products consumed mainly by the middle-and upper-middle classes. However, they said the automated bakery and confectionery units have gradually grabbed a major stake in the local market at the cost of the traditional ones which are now struggling to survive amid a tough competition. The leading conglomerates have captured over 60 per cent of the market over the last two decades, according to an estimate by the industry insiders. Their presence in the market with huge investments, higher production capacity, a wide range of products and marketing competence gave them an upper hand over traditional factories. Apart from leading bakery companies like Olympic, Pran, Partex, Haque, Nabisco, Bangas and Akij, conglomerates like Bashundhara Group, Kohinoor and others have entered the market in recent times. With the increasing demand for dry foods like biscuits, bread, cakes, bun, toasts and other items, the big corporate houses are investing notably in the sector, the current market size of which is estimated at Tk 80 billion, according to the stakeholders concerned. The share of imported products declined to below 4.0 per cent in the recent years from 15-16 per cent one and a half decades back, said industry insiders. Changing food habits amid rising income of the people has helped the sector maintain a 10-12 per cent growth for last two decades, according to the Bangladesh Auto Biscuit and Bread Manufacturers Association (BABBMA) and Bangladesh Bread, Biscuits O Confectionery Prostutkarok Samity (BBBCPS), an association of the traditional factories. However, the sector was among the few businesses that showed an accelerated growth and increased profits even during the pandemic, thanks to the growing demand for dry food. The traditional units were, however, struggling hard to compete with the diversified products of the automated ones having direct access to the super shops, groceries, departmental stores and tea stalls. Even the products are being delivered to the doorsteps nowadays through online platforms, said the market insiders. From 5,700 units in 2008, the number of traditional bakery and confectioneries shrank to 4,500 units in 2019, according to the BBBCPS. According to the associations, around 100 automated factories and more than 4,500 traditional ones were producing over 0.2 million tonnes of biscuits worth Tk 50 billion annually in the country. BABBMA, BBBCPS and Bangladesh Agro-Processors Association (BAPA) records show that the country''s per capita bakery item consumption is now 2.09 kg per year which was hardly 0.43 kg in 2008. The local companies have emerged with traditional cookies, special toasts, dry cakes, sweet toasts, cream milk cookies, coconut cookies, low sugar biscuits, chocolate biscuits, butter milk biscuits, tea time cookies, nut biscuits, cheesy cookies and other varieties of products. Established in 1979, Olympic Industries is the largest manufacturer, distributor and marketer of biscuits in Bangladesh, according to the BABBMA. The listed company, which alone meets 20-25 per cent of the market demand, has also decided to invest afresh Tk 420 million to enhance its production capacity further, according to a disclosure. It will be able to produce additional 12,442 tonnes of bakery items with the new facility, taking the total capacity to 0.129 million tonnes, said sources at the company. Pran, the second biggest market player, has also planned to raise its production capacity by opening new factories. Md Kamruzzaman, director (marketing) at Pran, said their production capacity increased by 10 per cent in recent months and was growing day by day. ''We are also exporting biscuits to 141 countries while our current annual export growth is around 40 per cent,'' he said. However, Pran is now the market leader in bun and cakes with more than 25 per cent market share, according to BABBMA. ''All Time'', a Pran brand of cakes and buns, is the highest sold items in the segment due to a vast range of products as well as an efficient marketing channel, according to the association. Pran entered the biscuit market in 2012, introduced varieties of biscuits and stood second in the market by now, according to BABBMA. Nabisco Biscuit and Bread Factory, is the second in biscuit sales jointly with Pran, said BABBMA. The country''s oldest biscuit brand, now manufactures more than two dozens of varieties of products. Akij Group has also entered the market in recent years with huge investment as the company targeted the groceries, departmental stores and roadside tea stalls with its varieties of products and a wide marketing channel, said the insiders. Other biscuits and confectionery brands like Haque, Al-Amin, Partex, New Olympia, Ispahani, Bangas, Romania, Fu-Wang, Bonoful, Thai Food, Bengal, Gold Mark, Mashafi, Ifad, Cocola, Pinnacle etc. have also made a good mark in the market, according to the BABBMA. Md Shafiqur Rahman Bhuiyan, president of BABBMA, said the sector''s growth increased by 20 per cent during the pandemic due to rising demand for packaged dry foods. He said many companies have reinvested while many others are coming to the market which is likely to benefit the consumers due to tough competition. Mr Bhuiyan said the sector might further boom with the launch of the ''school mid-day meal programme'' where the students would get bakery items. Links to online food delivery platforms ''Local automated bakery, confectionery and snack companies are gradually been connecting themselves with the online delivery platforms to resonate with the changing tempo of the new millennium marketing arena,'' said Mr Bhuiyan. He said that online sales still remained below 2.0 per cent of the total transactions, but they are expecting it to be 15 per cent in next three years. Products of Pran, Golden Harvest, Bashundhara, Olympic, Akij, Partex, Ifad, Meghna and many other competitive companies are now available on online platforms like Chaldal, Foodpanda, Hungry Naki, Daraz, Sohoz.com etc. Big companies force traditional ones to struggle Bashundhara Group and Kohinoor have entered the market recently to intensify the market competition, said sources. When the automated factories have gradually been fetching the major share of the market, traditional bakery and confectioneries were struggling for their existence. Md Jalal Uddin, president of BBBCPS, told the FE that competition from big companies have forced more than 20 per cent of the small ones to shut down their operation in last 10 years. He said the automated factories have even started to grab the market of the roadside tea stalls, which are the key consumers for small-scale factories. The production cost of traditional factories is 20-25 per cent higher than that of the automated ones, which is creating an uneven competition, he added. He said that some old traditional bakeries like Mamataj, Muslims, Prince, Chhayaneer, Shahjalal, etc. were still doing good businesses among the middle and upper middle-classes. He said the companies were still present with their traditional cookies, toasts, bread etc. having demands. Many of them were making western fast-foods even with local flavour, he added. But the rest ones were facing tough condition especially during the pandemic, he said. He further informed that though the automated companies'' profit margin increased during the lockdown period last year, traditional factories incurred huge losses for the closure of roadside tea stalls, small-scale groceries and other shops. Many of the factories closed their operation while others squeezed production by 60-70 per cent during the period, he added. Mr Uddin also pointed out that increased prices of wheat, sugar, oil and other essential ingredients were causing further losses to them. According to the stakeholders, the local biscuit industry is growing at a double digit for the last one decade or so due to diversified products and rising demand. Nearly 80 per cent of the biscuits are produced in the automated factories, 19 per cent in traditional units and 1.0 per cent is coming from imports. ''Import volume of biscuit products has dropped to 1,300 tonnes in 2022 from 7,200 tonnes in 2009 as many local companies are now making such varieties,'' said Mr Bhuiyan. According to the Bangladesh Agro-Processors Association, 36 firms were exporting 20-22 varieties of bakery products including breads, cakes, buns, rusks, and biscuits worth more than US$100 million annually to 144 countries. Insiders said automation in the factories has paved the way for diversification and quality improvement of products that have helped the sector compete with imported items. They said the local bakery industry might grow further by adopting a ''food fortification'' strategy to supply nutrition to the people at affordable prices. According to BABBMA and BAPA, the market could reach $5.0 billion by 2025. ''We are confident that we can enter more new markets through diversification and quality improvement,'' said Mr Bhuiyan. Automation increases production capacity Bashundhara entered the biscuit market with ''Mostafa'', a new product line which is now available in superstores, groceries and shops. It is producing large-scale varieties of biscuits and snacks at its plant in Khulna. The company produces 1,200 tonnes of products per month. ''We are planning to expand the existing factory considering the growing demand,'' said Mostafa Kamal, chairman of Bashundhara Group. He said their products were also getting huge responses from different destinations across the country. Apart from this, ''Olympic'', ''Haque'', ''Pran'' and other local companies were expanding their production capacity by installing new machinery to grab the growing market demand. ''We installed a number of ovens last year to expand our production capacity further,'' said Shahnaz Parveen, general manager (GM), marketing at Olympic. ''We are installing some more new production lines to grab the growing market demand,'' she said. Products with nutrition value win consumers Mr Kamruzzaman of Pran said that they were producing a variety of bakery items enriched with high-protein value targeting the consumers from all classes. He said they were producing bread and other items enriched with different ingredients including vitamins, butter, dry fruits, egg etc. ''Our diversified products, timely delivery and efficient distribution have helped the group grow faster,'' he added. ''Our biscuits and breads are consumed by people from all walks of life,'' he said. Meanwhile, the sector''s stakeholders are also adopting food fortification technique by increasing micronutrient contents in the products to support nutritional needs of the people. According to BAPA, around 100 varieties of biscuits were now available in the market of which nearly 60-70 per cent had increased nutritional values. The automated companies were marketing products enriched with nutrients to attract health-conscious consumers, said Mr Bhuiyan. ''These companies have come up with different versions of nutrient-enriched biscuits and other bakery products,'' he said. ''The growing number of modern trade outlets and high-income segment customers are consuming more of these products,'' said the BABBMA president. Pran, Olympic, Haque, Bashundhara and other leading companies were manufacturing biscuit and bakery products enriched with ''food fortification,'' the sources said. Some companies, however, were producing low-sugar, butter, and other healthy biscuits to meet growing demand from health-conscious consumers, they added. BABBMA president said they were confident that ''food fortification'' would help the industry grow further and win the consumers in local and global markets. Apart from this, more investors were showing interest to enter the industry as the diversified product range and demand were increasing significantly, he added. The BBBCPS president said they were trying to upgrade the standards of traditional units while keeping the local flavour in products to hold their market share. The associations, however, expressed the hope that they would meet 50 per cent of the local demand for such products in the next five years.